|

High Tales of The Week

Solana ETF regulatory filings flood in as Gensler units departure date

Cboe BZX Change submitted 4 19b-4 filings for asset managers to record spot Solana exchange-traded funds (ETFs) on Nov. 21 — the identical day the USA Securities and Change Fee Chair Gary Gensler confirmed he would resign in January.

If accredited, the Bitwise, VanEck, 21Shares and Canary Capital-issued spot Solana ETFs can be listed on the Cboe BZX Change.

The 19b-4s inform the SEC of a proposed rule change by a self-regulatory group comparable to a monetary regulatory physique or inventory alternate.

They differ from Type S-1 registration statements, which VanEck and 21Shares already submitted for his or her Solana ETFs in late June and Canary Capital filed 4 months later, on Oct. 30.

FTX gives timeline for creditor and consumer reimbursement payouts

The FTX chapter property up to date its timeline for creditor and former buyer reimbursements — which must be finalized in January 2025 — with preliminary payouts anticipated in March 2025.

In accordance with a Nov. 21 announcement from the collapsed crypto alternate, FTX will prepare reimbursement funds in early December with distribution brokers who will deal with the payout course of and handle the shopper payout portal. John J. Ray III, the interim CEO presiding over the FTX chapter, stated:

“Whereas we proceed to take actions to maximise recoveries, we’re full steam forward to achieve preparations with our distribution brokers and return proceeds to collectors and prospects as shortly as potential.”

SEC Chair Gary Gensler to step down

United States Securities and Change Fee (SEC) Chair Gary Gensler, recognized for his hardline stance on cryptocurrency regulation, will depart from the company on Jan. 20, 2025, the securities regulator stated in a Nov. 21 announcement.

Gensler will depart the company on the identical day crypto-friendly President-elect Donald Trump begins his second presidential time period, in accordance with the announcement.

“It has been an honor of a lifetime to serve with them on behalf of on a regular basis Individuals and make sure that our capital markets stay the most effective on this planet,” Gensler stated in a press release.

In July, Trump vowed to “hearth” Gensler in a bid to woo crypto lovers forward of the Nov. 5 US presidential election.

The president has the authority to pick a chair to move the SEC, however he can not pressure a commissioner to depart the company fully, as Gensler plans to do in January.

MicroStrategy completes $3B elevate to purchase extra Bitcoin as MSTR falls 25%

MicroStrategy has accomplished a $3 billion providing of 0% convertible senior notes due in December 2029, with plans to make use of a portion or the entire proceeds to purchase extra Bitcoin.

The enterprise intelligence agency introduced the completion as its shares retraced greater than 25% on Nov. 21, Google Finance information reveals.

The convertible senior notes got here at a 55% premium with an implied strike worth of round $672 — a predetermined worth at which an possibility holder should buy or promote MicroStrategy’s class A standard inventory.

The 0% senior convertible word means it is not going to pay common curiosity to bondholders. These convertibles are bought at a reduction and can as a substitute mature to face worth if they aren’t transformed previous to the maturity date.

Coinbase CEO to fulfill with Trump to debate personnel appointments — WSJ

Brian Armstrong, the CEO of United States-based cryptocurrency alternate Coinbase, will reportedly meet with Donald Trump because the president-elect continues to announce workers picks for his administration and the heads of presidency departments.

In accordance with a Nov. 18 Wall Avenue Journal report, Trump supposed to fulfill privately with Armstrong to debate personnel appointments. The Coinbase CEO didn’t seem to have donated on to the Republican’s 2024 marketing campaign or political motion committees (PACs) instantly supporting him however stated earlier than the US election the crypto alternate could be ready to work with a Trump administration.

It’s unclear whether or not Armstrong or a Coinbase worker may probably have a task within the subsequent US president’s administration.

Winners and Losers

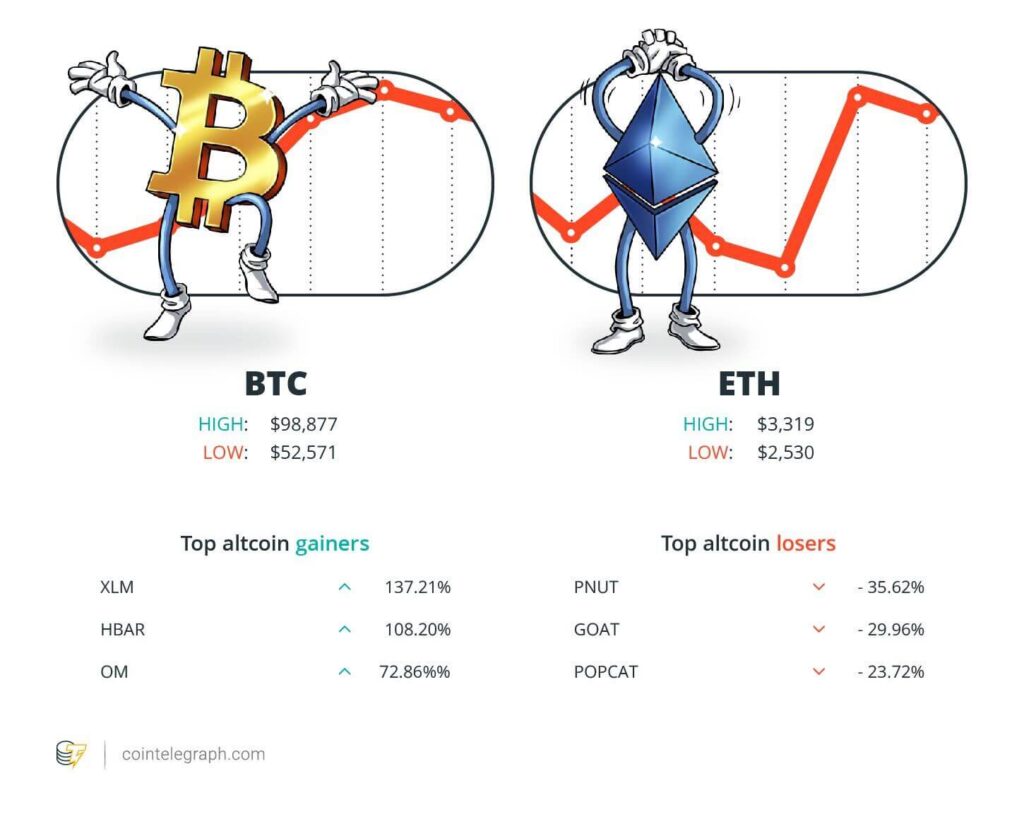

On the finish of the week, Bitcoin (BTC) is at $98,877, Ether (ETH) at $3,319 and XRP at $1.47. The overall market cap is at $3.31 trillion, in accordance with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Stellar (XLM) at 137.21%, Hedera (HBAR) at 108.20% and Mantra (OM) at 72.86%.

The highest three altcoin losers of the week are Peanut the Squirrel (PNUT) at 35.62%, Goatseus Maximus (GOAT) at 29.96% and Popcat (SOL) (POPCAT) at 23.72%. For more information on crypto costs, be sure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“The advantage of memecoins is that they get the people who find themselves solely in [crypto] for primarily speculative causes and are considering very short-term — it attracts these individuals.”

Jeffrey Zirlin, co-founder of Sky Mavis

“On this shortly altering crypto panorama, it can’t be overstated how vital these federal judges and prepared companions, are for resolutions.”

Adam Moskowitz, managing companion at The Moskowitz Regulation Agency

“These choices had been nearly definitely a part of the transfer to the brand new Bitcoin all-time highs at this time.”

James Seyffart, ETF analyst at Bloomberg Intelligence

“I took the simple path, the cowardly path, as a substitute of doing the precise factor. I’ll spend the remainder of my life attempting to make amends.”

Gary Wang, co-founder of FTX

“So long as there may be retail dealer disbelief, whales can proceed pumping cryptocurrencies with little resistance.”

Santiment, onchain evaluation agency

“Whereas the SEC has plausibly alleged its concept of securities violations in opposition to Kraken, solely discovery will set up whether or not the gross sales, trades, and exchanges on Kraken actually met all of the Howey parts.”

William Orrick, senior United States district choose for the Northern District of California

Prediction of The Week

Bitcoin again to $90K subsequent? Merchants diverge on BTC worth pullback odds

Bitcoin confronted a critical problem hitting $100,000 on Nov. 22 as $300 million in sell-side liquidity blocked the way in which.

Knowledge from Cointelegraph Markets Professional and TradingView confirmed BTC worth draw back taking on on the Wall Avenue open.

Learn additionally

Options

Tokenizing music royalties as NFTs may assist the following Taylor Swift

Options

Ought to we ban ransomware funds? It’s a beautiful however harmful thought

A visit towards the important thing six-figure mark earlier resulted in defeat as sellers lined as much as forestall BTC’s worth from climbing increased — a typical characteristic for Bitcoin round key psychological ranges.

“FireCharts reveals a large Bitcoin promote wall compressed between the $99.3k – $100k vary,” buying and selling useful resource Materials Indicators confirmed in its newest submit on X.

Others thought of the place a possible deeper worth retracement could find yourself, with widespread pseudonymous dealer Crypto Chase eyeing $90,000 in what he referred to as the “optimum state of affairs.” Crypto Chase defined this “rinse” could be “wholesome worth motion” to proceed previous $100,000.

Fellow pseudonymous dealer CJ had a better goal targeted on the mid-$90,000 vary.

FUD of The Week

South Korea’s Delio declared bankrupt with $1.75B in belongings misplaced

South Korean digital asset deposit platform Delio was declared bankrupt by a court docket in Seoul on Nov. 22, in accordance with a number of native press reviews. Delio, which owes prospects 245 billion gained ($1.75 billion), halted withdrawals final yr.

Delio will start liquidation proceedings. Prospects could make claims by Feb. 21, 2025, and the primary collectors’ assembly can be held on March 19, 2025. Studies quote a court docket official as saying:

“The debtor leased and entrusted the administration of customer-deposit digital belongings to the administration firm, however a big a part of it was deposited and managed within the FTX account.”

Coinbase scammer claims to earn 5 figures per week concentrating on crypto CEOs

Crypto phishing scammers are apparently incomes five-figure weekly incomes by impersonating Coinbase help and utilizing leaked information to focus on high-ranking crypto executives and software program engineers.

Nick Neuman, CEO and co-founder of Bitcoin self-custody options supplier Casa, stated he was lately referred to as by a “Coinbase help” scammer and came upon greater than anticipated after he “determined to show the tables on him and ask him about being a scammer.”

“We make a minimal of 5 figures per week. We hit $35K two days in the past; we do it for a motive, there may be cash to be made in it,” responded the scammer when requested how a lot they made.

Learn additionally

Options

Why are crypto followers obsessive about micronations and seasteading?

Options

NFT collapse and monster egos characteristic in new Murakami exhibition

Neuman posted the dialog in a video on X on Nov. 20 through which the scammer orchestrated the assault by stating {that a} password change request had been canceled and a notification had been despatched.

US fees 5 in $11M crypto hacking scheme linked to ‘Scattered Spider’

United States prosecutors charged 5 individuals with being a part of a gaggle that hacked dozens of companies and people to steal $11 million in crypto and delicate data.

The USA Lawyer’s Workplace for the Central District of California stated on Nov. 20 that the defendants despatched SMS phishing hyperlinks or SIM-swapped people and staff of sure firms to steal login credentials to their work or crypto alternate accounts.

Courtroom paperwork seen by Cointelegraph detailed at the very least 29 alleged particular person crypto-theft victims. Prosecutors claimed one sufferer was robbed of greater than $6.3 million price of crypto after having their electronic mail and wallets breached.

High Journal Tales of The Week

Crypto has 4 years to develop so large ‘nobody can shut it down’: Kain Warwick, Infinex

Kain Warwick says Infinex and different crypto platforms ought to undertake the Uber mannequin and grow to be so large and helpful they’ll’t be shut down.

Bitcoin’s $100K push wakes taxman, Vitalik visits actual Moo Deng: Asia Specific

Governments eye crypto tax as Bitcoin reaches for $100K, China choose says BTC is a commodity, crypto scandal erupts in Indian elections, and extra.

110M Doodles espresso cups seem at McDonald’s throughout the US: NFT Collector

110 million Doodles espresso cups have launched in McDonald’s throughout the US within the largest NFT partnership up to now

Subscribe

Probably the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Employees

Cointelegraph Journal writers and reporters contributed to this text.

Learn additionally

Hodler’s Digest

Bitcoin carnage, Eth2 milestone, Libra launch, PayPal blunder: Hodler’s Digest, Nov. 21–27

Editorial Employees

9 min

November 28, 2020

The very best (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — one week on Cointelegraph in a single hyperlink!

Learn extra

Columns

Crypto Metropolis: The final word information to Miami

ZhiyuanSun

14 min

July 13, 2022

With a tropical local weather, low taxes and various inhabitants, Miami-Dade County is without doubt one of the most prosperous and blockchain-friendly cities in the USA.

Learn extra