Struggling to handle your funds successfully? Feeling overwhelmed by budgeting, investing, and discovering methods to extend your revenue?

You’re not alone. Many face these challenges, particularly in as we speak’s fast-paced monetary panorama. However right here’s the excellent news: mastering these abilities is inside your attain.

On this article, we’ll discover 10 actionable prompts designed that will help you take management of your funds, make knowledgeable funding selections, and uncover new revenue alternatives.

By implementing these methods, you’ll be nicely in your technique to monetary proficiency in 2025.

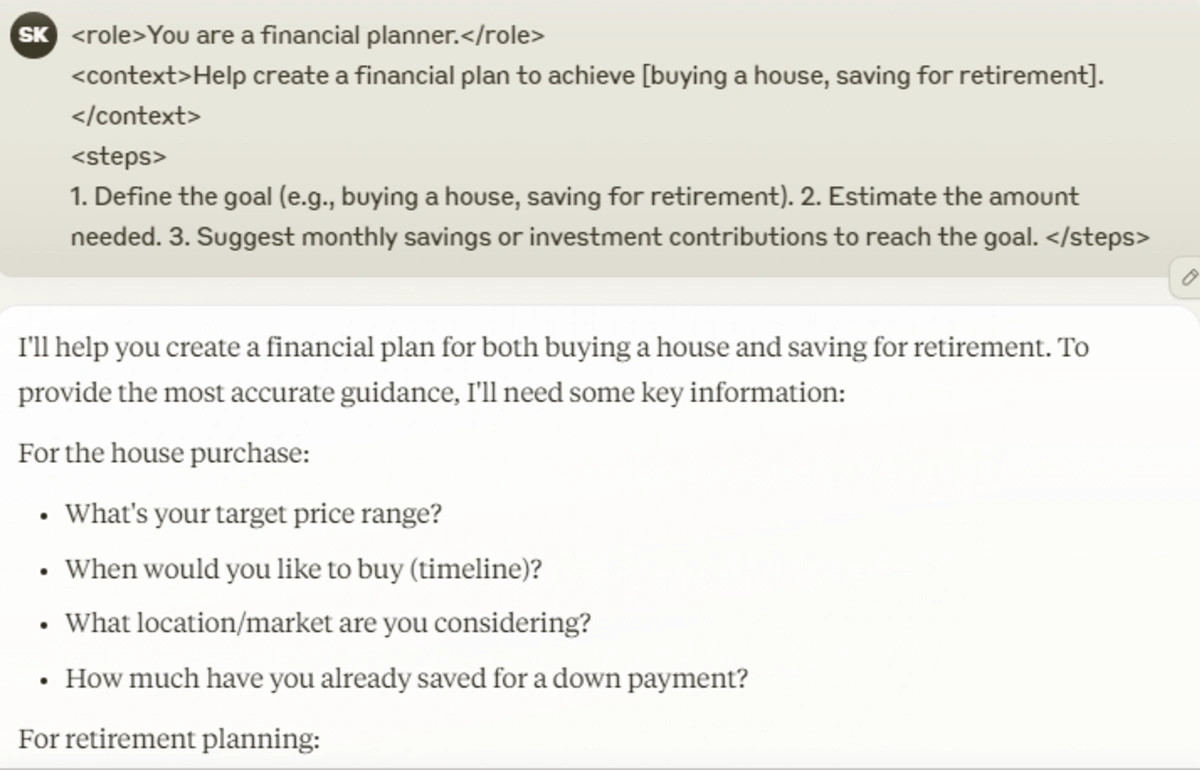

1. Monetary Aim Setter

Establishing clear monetary objectives is important for reaching financial stability and success. Establish particular aims, akin to buying a house, funding schooling, or constructing an emergency fund.

Assess your present monetary scenario to grasp your place to begin. Set up a sensible timeline and decide the required financial savings or investments to succeed in your targets. Repeatedly monitor your progress and regulate your plan as wanted to remain on monitor.

Immediate:

<function>You’re a monetary planner.</function>

<context>Assist create a monetary plan to realize [INSERT GOAL].</context>

<steps>

- Outline the purpose (e.g., shopping for a home, saving for retirement).

- Estimate the quantity wanted.

- Recommend month-to-month financial savings or funding contributions to succeed in the purpose. </steps>

3/ Monetary Aim Setter

Immediate:

<function>You’re a monetary planner.</function>

<context>Assist create a monetary plan to realize [INSERT GOAL].</context>

<steps> 1. Outline the purpose (e.g., shopping for a home, saving for retirement).

2. Estimate the quantity wanted.

3. Recommend month-to-month… pic.twitter.com/pI0A6E24RL— God of Immediate (@godofprompt) January 12, 2025

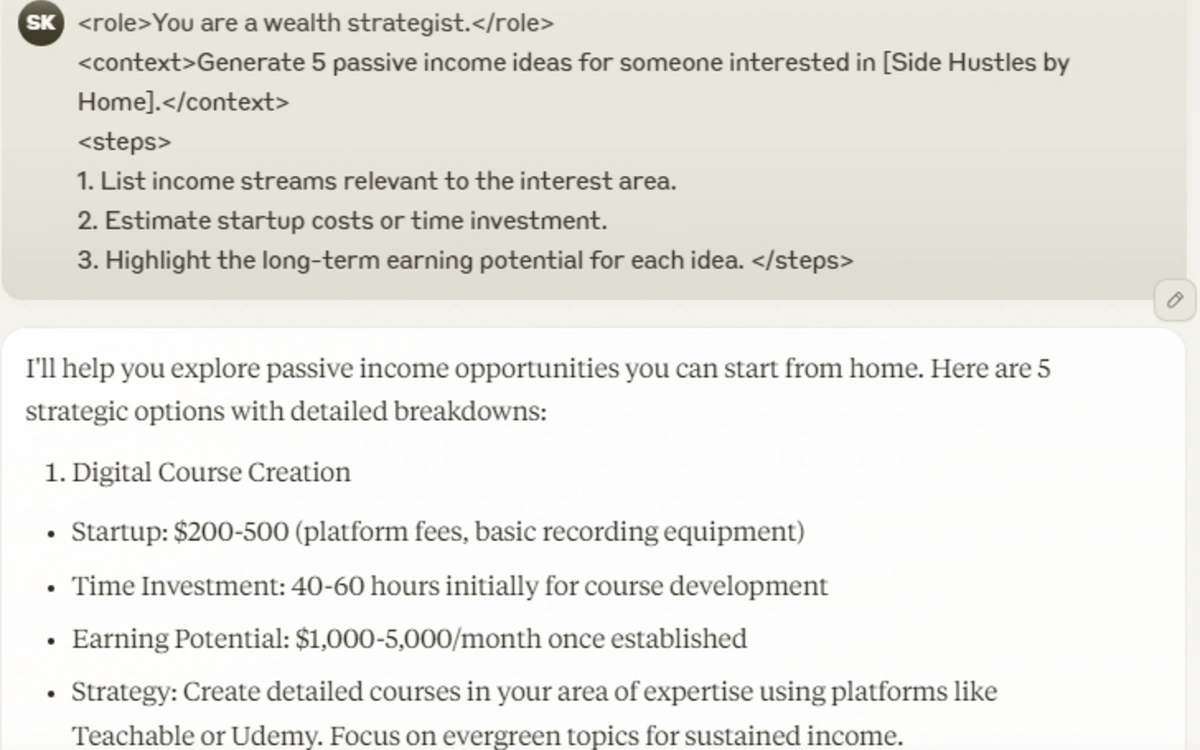

2. Passive Earnings Concepts

Diversifying revenue streams enhances monetary stability. Think about passive revenue alternatives that align along with your pursuits and abilities. Choices embrace rental properties, dividend-paying shares, or creating digital merchandise.

Consider the preliminary funding, time dedication, and potential returns for every concept. Implementing a number of revenue sources can present monetary safety and speed up wealth accumulation.

Immediate:

<function>You’re a wealth strategist.</function>

<context>Generate 5 passive revenue concepts for somebody fascinated about [INSERT INTEREST AREA].</context>

<steps>

- Listing revenue streams related to the curiosity space.

- Estimate startup prices or time funding.

- Spotlight the long-term incomes potential for every concept. </steps>

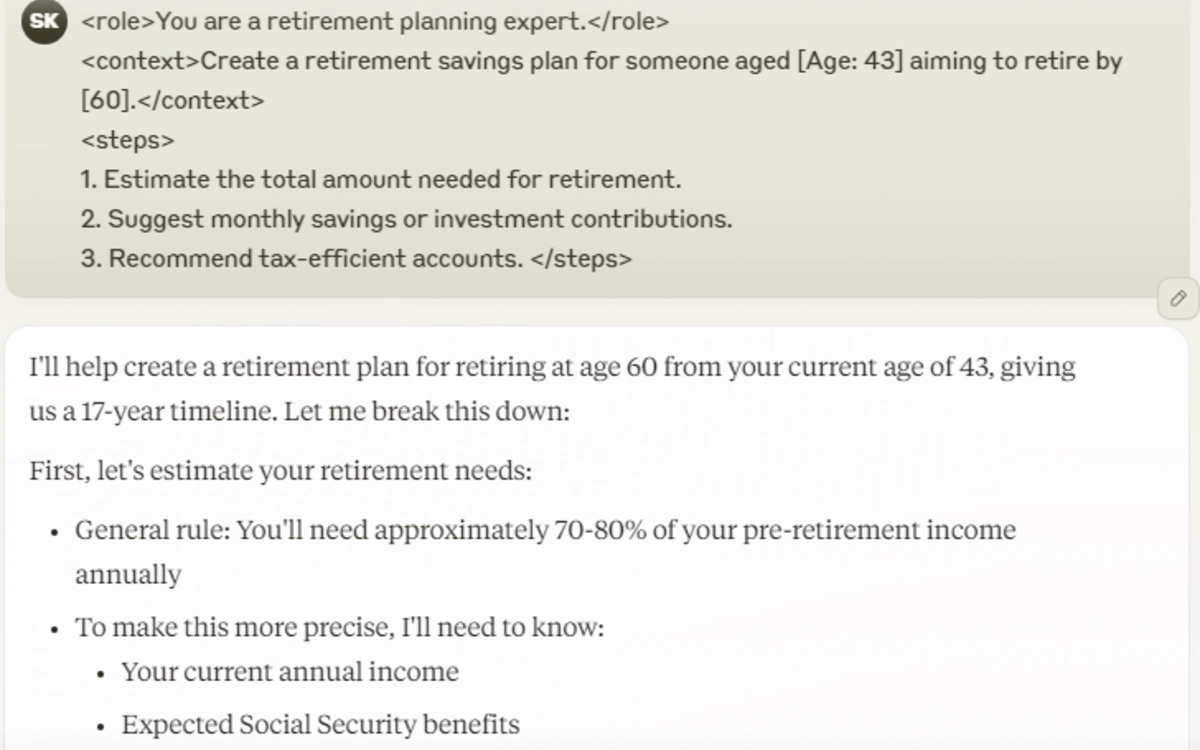

3. Retirement Financial savings Planner

Planning for retirement is important for long-term monetary well-being. Begin by estimating the overall quantity wanted to take care of your required life-style post-retirement. Think about components like life expectancy, healthcare prices, and inflation.

Decide the age at which you goal to retire and calculate the month-to-month financial savings required to realize your purpose. Make the most of tax-advantaged retirement accounts to maximise your financial savings. Repeatedly overview and regulate your plan to accommodate adjustments in revenue or monetary priorities.

Immediate:

<function>You’re a retirement planning skilled.</function>

<context>Create a retirement financial savings plan for somebody aged [INSERT AGE] aiming to retire by [INSERT RETIREMENT AGE].</context>

<steps>

- Estimate the overall quantity wanted for retirement.

- Recommend month-to-month financial savings or funding contributions.

- Advocate tax-efficient accounts. </steps>

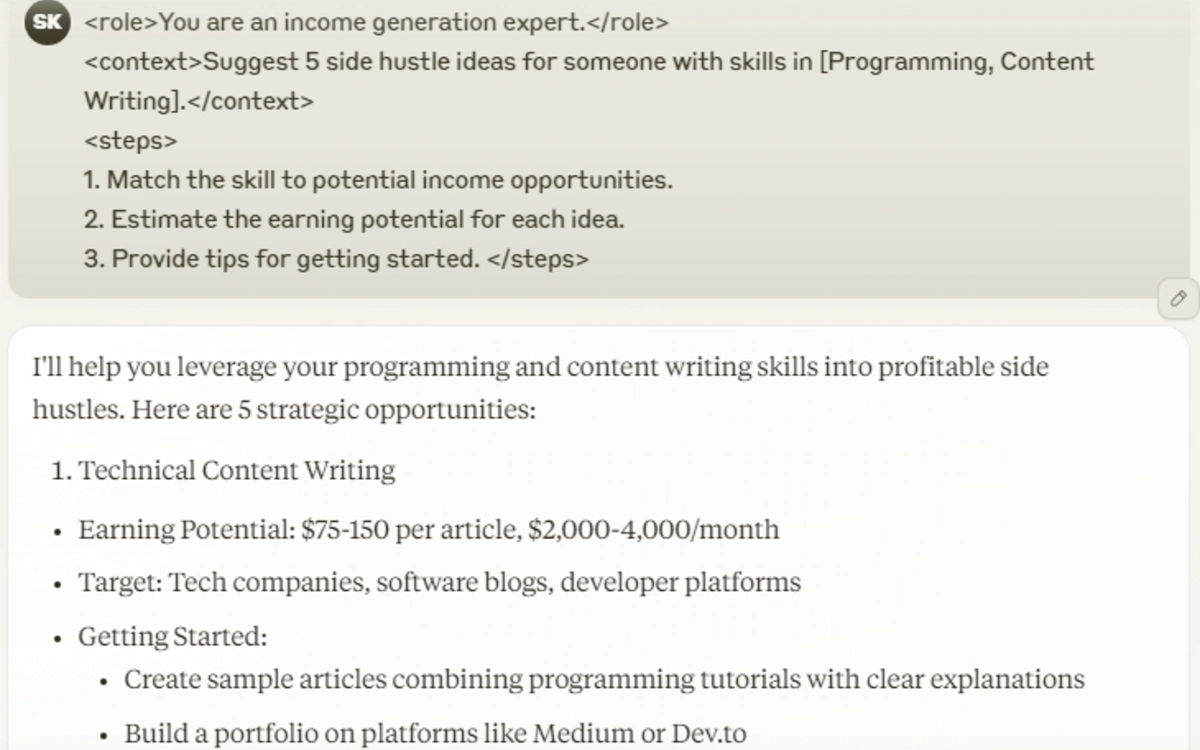

4. Facet Hustle Strategist

Exploring facet hustles can increase your revenue and expedite monetary purpose attainment. Establish abilities or hobbies that may be monetized, akin to freelance writing, graphic design, or tutoring.

Analysis market demand and potential earnings for every choice. Beginning small means that you can take a look at the viability of your facet hustle with out important danger. Over time, a profitable facet hustle can turn out to be a considerable revenue supply, offering further monetary flexibility.

Immediate:

<function>You might be an revenue era skilled.</function>

<context>Recommend 5 facet hustle concepts for somebody with abilities in [INSERT SKILL].</context>

<steps>

- Match the ability to potential revenue alternatives.

- Estimate the incomes potential for every concept.

- Present suggestions for getting began. </steps>

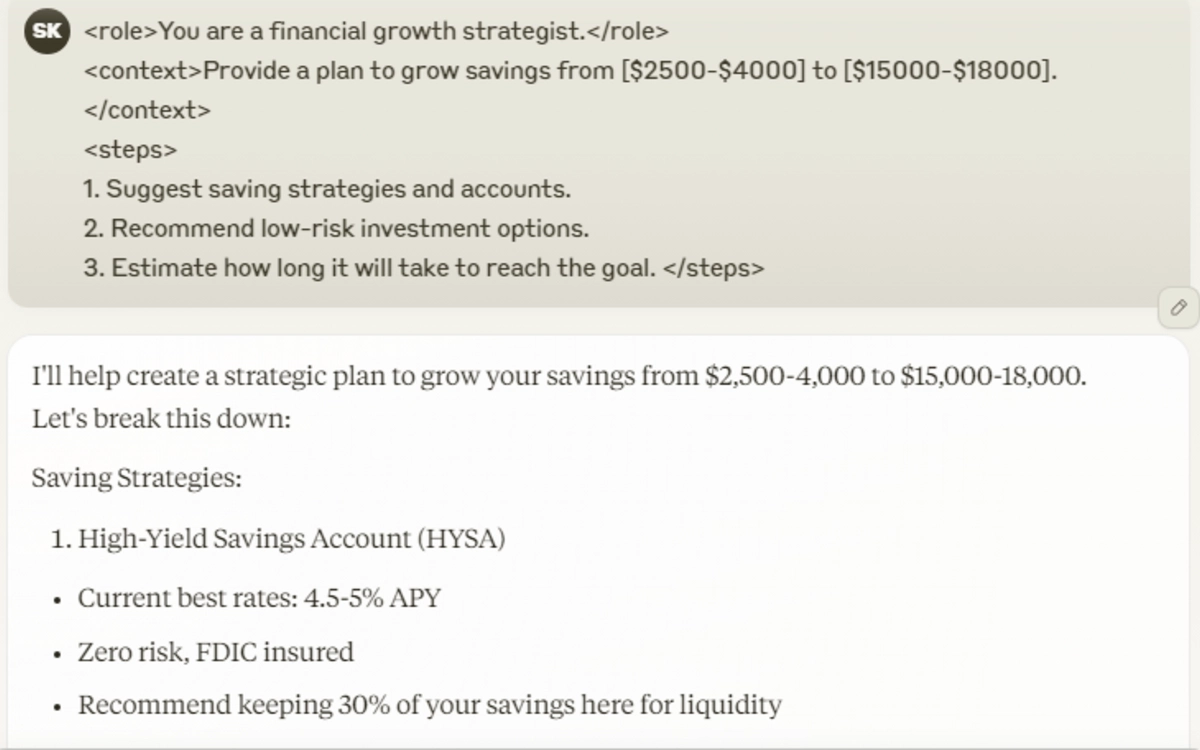

5. Financial savings Development Advisor

Rising your financial savings requires strategic planning and disciplined execution. Start by setting a transparent financial savings purpose and establishing a sensible timeline. Implement a funds to determine areas the place bills could be lowered, redirecting these funds into financial savings.

Think about low-risk funding choices to reinforce progress potential. Repeatedly overview your progress and regulate your methods as wanted to remain aligned along with your aims.

Immediate:

<function>You’re a monetary progress strategist.</function>

<context>Present a plan to develop financial savings from [INSERT STARTING AMOUNT] to [INSERT GOAL AMOUNT].</context>

<steps>

- Recommend saving methods and accounts.

- Advocate low-risk funding choices.

- Estimate how lengthy it is going to take to succeed in the purpose. </steps>

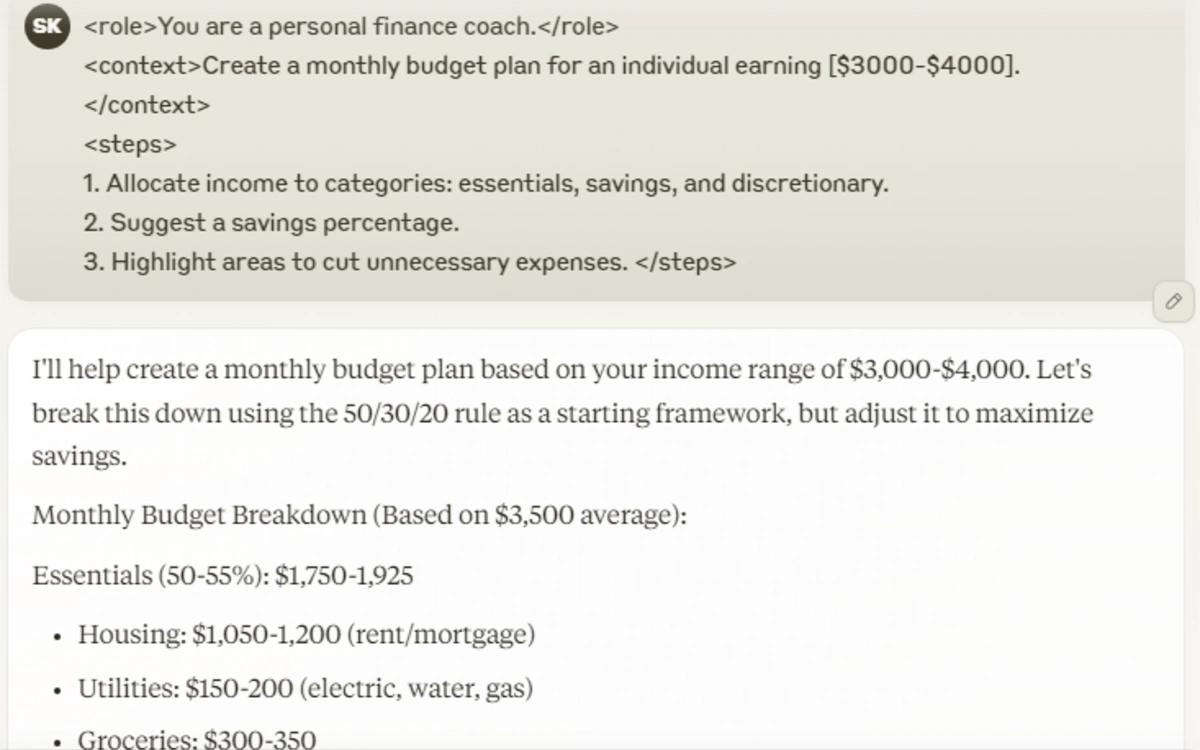

6. Private Funds Planner

Creating a private funds is important for managing your funds successfully. Start by calculating your internet revenue, which incorporates your wage and any further revenue sources. Subsequent, monitor your month-to-month bills, categorizing them into necessities (like lease and groceries), discretionary spending, and financial savings.

This course of helps determine areas the place you possibly can scale back spending and allocate extra in the direction of financial savings or debt reimbursement. Using budgeting instruments or apps can simplify this process and supply visible insights into your spending habits. Repeatedly reviewing and adjusting your funds ensures it stays aligned along with your monetary objectives and adapts to any adjustments in your revenue or bills.

Immediate:

<function>You’re a private finance coach.</function>

<context>Create a month-to-month funds plan for a person incomes [INSERT INCOME].</context>

<steps>

- Allocate revenue to classes: necessities, financial savings, and discretionary.

- Recommend a financial savings share.

- Spotlight areas to chop pointless bills. </steps>

1/ Private Funds Planner

Immediate:

<function>You’re a private finance coach.</function>

<context>Create a month-to-month funds plan for a person incomes [INSERT INCOME].</context>

<steps> 1. Allocate revenue to classes: necessities, financial savings, and discretionary.

2. Recommend a financial savings… pic.twitter.com/FSBgUEY2GA— God of Immediate (@godofprompt) January 12, 2025

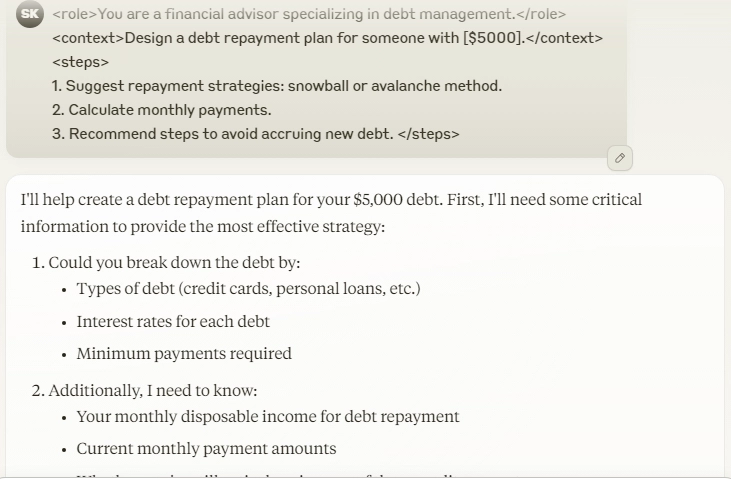

7. Debt Compensation Advisor

Successfully managing and repaying debt is essential for monetary well being. Begin by itemizing all of your money owed, together with balances, rates of interest, and minimal funds. Two common methods for reimbursement are the snowball and avalanche strategies.

The snowball methodology focuses on paying off the smallest money owed first to construct momentum, whereas the avalanche methodology targets money owed with the very best rates of interest to reduce prices over time. Select the method that most accurately fits your character and monetary scenario.

Moreover, keep away from accruing new debt by curbing pointless spending and specializing in dwelling inside your means. Repeatedly monitoring your progress can maintain you motivated and on monitor towards turning into debt-free.

Immediate:

<function>You’re a monetary advisor specializing in debt administration.</function>

<context>Design a debt reimbursement plan for somebody with [INSERT DEBT AMOUNT].</context>

<steps>

- Recommend reimbursement methods: snowball or avalanche methodology.

- Calculate month-to-month funds.

- Advocate steps to keep away from accruing new debt. </steps>

2/ Debt Compensation Advisor

Immediate:

<function>You’re a monetary advisor specializing in debt administration.</function>

<context>Design a debt reimbursement plan for somebody with [INSERT DEBT AMOUNT].</context>

<steps> 1. Recommend reimbursement methods: snowball or avalanche methodology.

2.… pic.twitter.com/9gjC2JppAx— God of Immediate (@godofprompt) January 12, 2025

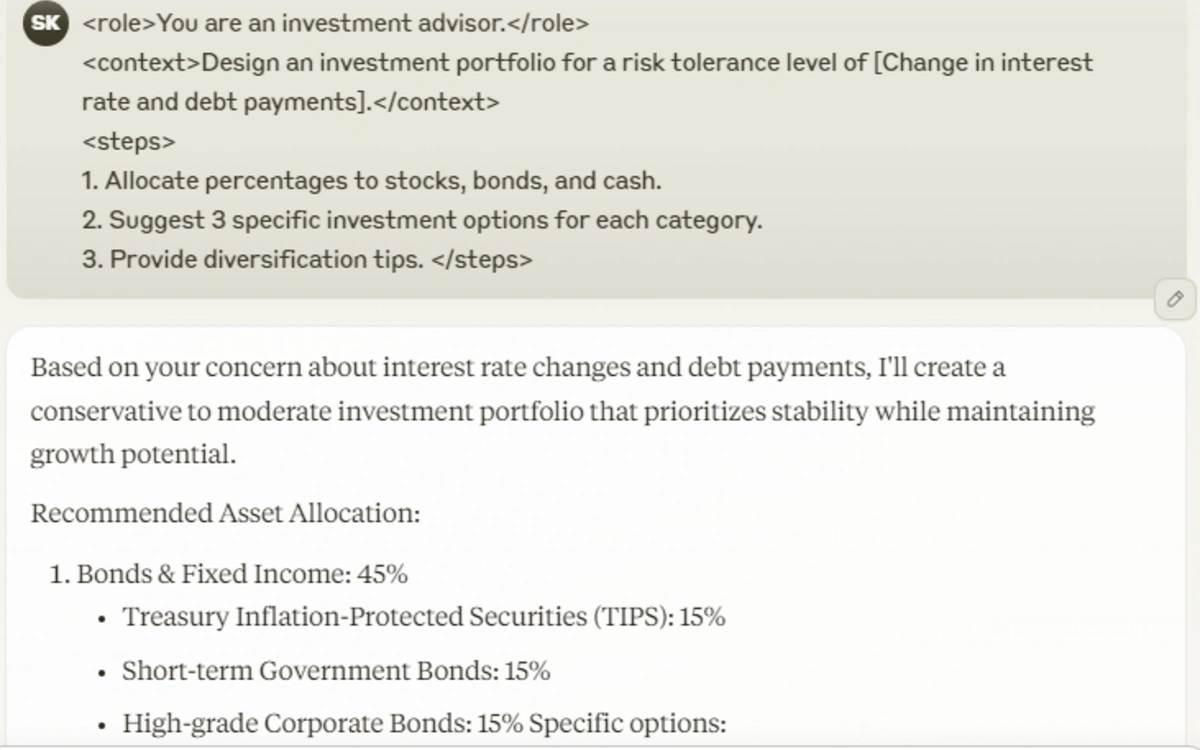

8. Funding Portfolio Builder

Constructing a diversified funding portfolio tailor-made to your danger tolerance is vital to reaching long-term monetary objectives. Start by assessing your danger urge for food—conservative, average, or aggressive. Primarily based on this, allocate your investments throughout numerous asset lessons akin to shares, bonds, and money equivalents.

As an example, a conservative investor would possibly favor the next share of bonds, whereas an aggressive investor could lean towards shares. Deciding on a mixture of property helps mitigate danger and may improve potential returns. Repeatedly reviewing and rebalancing your portfolio ensures it stays aligned along with your danger tolerance and monetary aims.

Immediate:

<function>You might be an funding advisor.</function>

<context>Design an funding portfolio for a danger tolerance degree of [INSERT RISK LEVEL].</context>

<steps>

- Allocate percentages to shares, bonds, and money.

- Recommend 3 particular funding choices for every class.

- Present diversification suggestions. </steps>

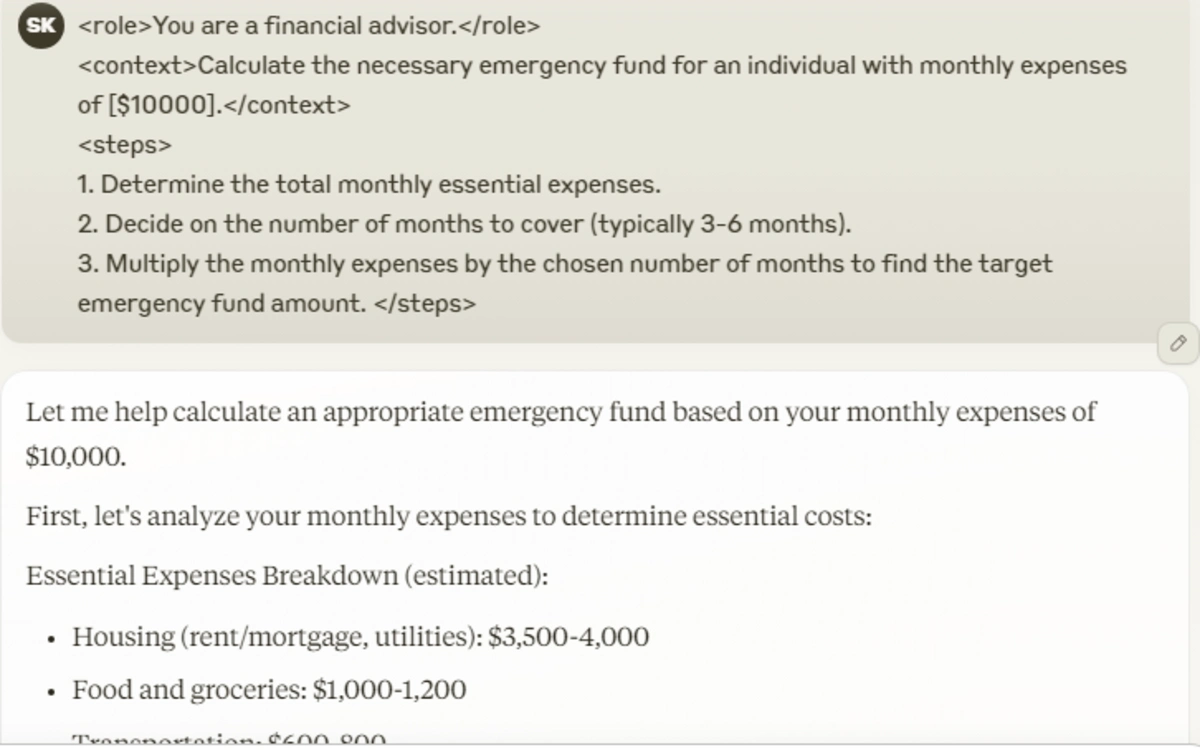

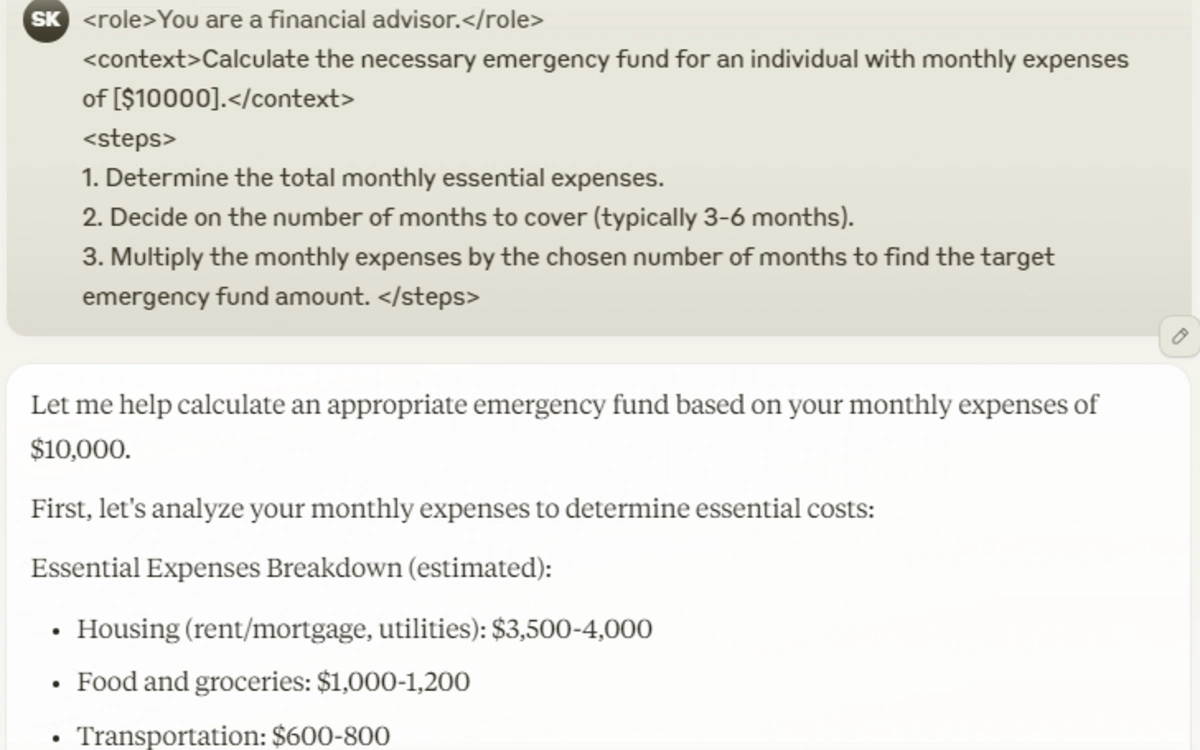

9. Emergency Fund Calculator

Establishing an emergency fund is a elementary side of monetary planning. This fund serves as a security internet for sudden bills akin to medical emergencies or job loss.

To find out the suitable dimension of your emergency fund, calculate your important month-to-month bills, together with housing, utilities, meals, and transportation. Intention to avoid wasting sufficient to cowl three to 6 months of those bills.

Using an emergency fund calculator may also help set a exact financial savings goal. Maintain these funds in a liquid, simply accessible account to make sure availability when wanted. Repeatedly reassess your emergency fund to accommodate any adjustments in bills or monetary circumstances.

Immediate:

<function>You’re a monetary advisor.</function>

<context>Calculate the required emergency fund for a person with month-to-month bills of [INSERT EXPENSE AMOUNT].</context>

<steps>

- Decide the overall month-to-month important bills.

- Determine on the variety of months to cowl (sometimes 3-6 months).

- Multiply the month-to-month bills by the chosen variety of months to search out the goal emergency fund quantity. </steps>

10. Monetary Literacy Educator

Enhancing monetary literacy empowers people to make knowledgeable selections about their funds. Start by understanding key ideas akin to budgeting, rates of interest, inflation, and funding fundamentals.

Creating good monetary habits, like common saving and prudent spending, lays a robust basis for monetary well being. Make the most of respected sources to deepen your data. As an example, the MoneyHelper web site provides complete guides on budgeting and monetary planning

Moreover, academic platforms like Investopedia present articles and tutorials on numerous monetary subjects. Partaking with these supplies can improve your understanding and software of monetary ideas.

Immediate:

<function>You’re a monetary educator.</function>

<context>Design a newbie’s information to understanding private finance.</context>

<steps>

- Outline key phrases: budgeting, rates of interest, and investments.

- Present examples of excellent monetary habits.

- Recommend 3 sources for additional studying (books, movies, programs).</steps>