5 years after its shares have been delisted from the crypto-critical ASX Australian inventory alternate, Animoca Manufacturers is trying to IPO once more, this time within the increasingly-crypto-friendly US.

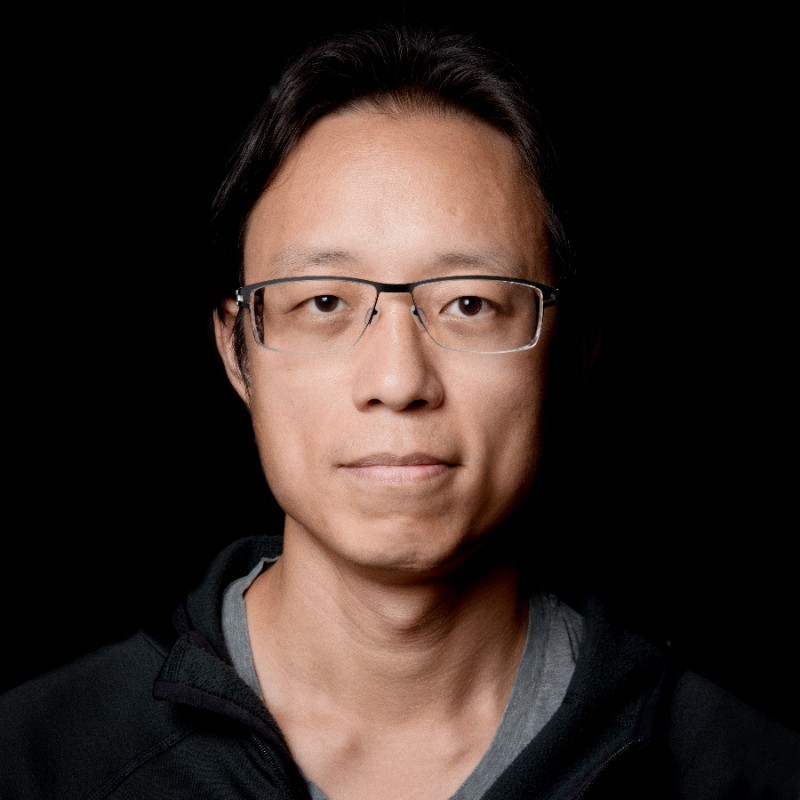

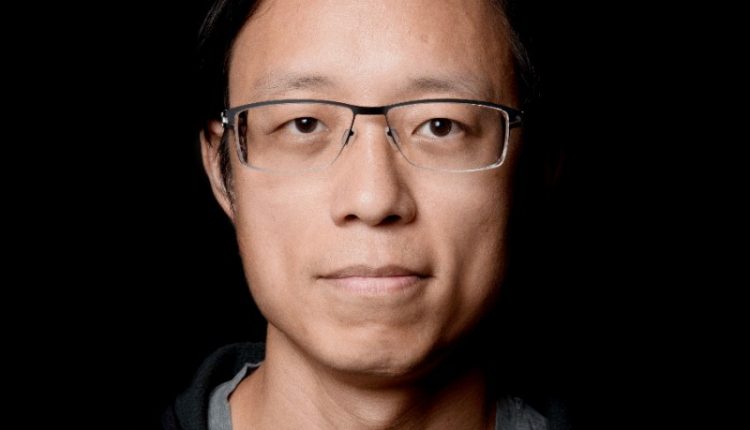

As detailed within the Monetary Instances, chairman Yat Siu is quoted as saying a US itemizing was “an important a part of the roadmap”, pointing each to altering regulatory circumstances in addition to the shortage of native competitors as a result of SEC’s propensity to sue US crypto corporations beneath the Biden administration.

Siu additionally commented “It’s a novel second in time. I really feel like it might be one heck of a wasted alternative if we didn’t at the very least attempt.”

Animoca’s most up-to-date financials element full yr 2024 bookings of $314 million, up 12% YoY — with complete property of $4.3 billion plus $2.9 billion-worth of tokens akin to SAND, EDU, MOCA and GMEE that are at the moment illiquid.

If nothing else, Animoca’s over 450 investments in blockchains and consumer-facing merchandise imply it might be capable of market its inventory as successfully the broadest crypto ETF, though it’s technically not a ETF however the inventory of a person firm.

An announcement may come “quickly”, Yat Siu advised the Monetary Instances, with the corporate inspecting a number of shareholding constructions.